Rumored Buzz on Offshore Banking

The European Union has introduced sharing of info in between particular territories, and also applied this in respect of specific regulated centers, such as the UK Offshore Islands, so that tax obligation details is able to be cooperated regard of passion (offshore banking). The Financial Institution Privacy Act calls for that Taxpayers submit an FBAR for accounts beyond the USA that have equilibriums in unwanted of $10,000 FATCA (the Foreign Account Tax Conformity Act) ended up being legislation in 2010 as well as "targets tax obligation non-compliance by US taxpayers with foreign accounts [and also] concentrates on reporting by US taxpayers regarding specific international financial accounts and also offshore properties [as well as] international financial institutions concerning monetary accounts held by united state

If you claimed the US, the UK, the major G7 banks will not take care of overseas financial institution facilities that don't follow G7 banks regulations, these financial institutions can not exist. They just exist due to the fact that they participate in transactions with common financial institutions." This perspective did not age well following rumors at Goldman Sachs, Wells Fargo, Barclays, HSBC, and others.

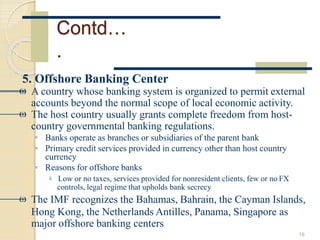

Offshore Financial Definition? Offshore banking is simply a term utilized to refer to the use of banking services in a foreign territory outside of the nation where one stays. So any type of person who owns a checking account in a foreign nation beyond their nation of home is engaging in offshore financial.

/800px-ING_Group_structure-6e6ce02cb1104164b37dd278744adc9b.png)

In the past, there were generally only a handful of jurisdictions in which financial institutions used overseas banking services, however, nowadays, one can open up an overseas checking account nearly anywhere - offshore banking. That being stated, there are still specific jurisdictions (such as Singapore, Belize, Cayman Islands and Switzerland) that are much more renowned for their usage as good offshore environments that have a perfect blend of monetary benefits along with solid financial plans and techniques.

Offshore Banking for Beginners

Offshore Bank Accounts, There are a few various means in which one can set about opening up an global financial institution account, in addition to various account types, which we will quickly check out: Personal Account vs. Corporate Account While it is possible to open up a personal offshore account in your very own personal name, it is typically suggested to include an overseas company in a foreign territory and ultimately open a corporate account as the company.

Corporate accounts are less complicated to open whereas individual accounts can be much more challenging. In concept, presumably much easier to open an account in your very own name compared to undergoing the extra steps of creating an offshore company, yet actually, having a company entity be the holder of the account permits many benefits, Developed banks will normally have much stricter demands for approving a foreign person rather than a company.

A business account supplies a lot better defense and also personal privacy. Opening an account in the name of an offshore firm divides and also dis-identifies you personally from the account.

It is extremely helpful to seek the right expert advice to help you with the process of creating a company overseas account in your chosen jurisdiction and also structuring it in one of the most useful method. What We provide? Offshore Defense uses multi administrative offshore approaches to restructure and also overseas your company and assets.

Offshore Banking for Dummies

Offshore Financial investment Account vs. Transactional Account, Besides selecting an individual account or a corporate account with an overseas company, there are a few other major account kinds, each with their own demands as well as usages. These different kinds of accounts can broadly be separated as financial investment accounts and transactional accounts. Financial investment accounts, They have a complex framework, usually requiring the formation of an overseas trust fund and a dependable financial investment manager or broker.

They are suitable for high-value financiers that want maximum returns and also protection for their riches and also do not prepare on having several transactions. offshore banking. Transactional accounts, They run likewise to received domestic transactional accounts. While they do not provide the very same series of investment choices as well as top services as big financial investment accounts, they work for those who intend to have simpler accessibility to their funds, make regular transactions, as well as that are just looking to initiate their offshore plan with a little and easy account.

We normally advise the last because of the added safety, protection that an LLC brings. Remote Account Opening, Particular jurisdictions as well as account types provide themselves more to opening an account remotely (e. g. Belize), as well as in specific circumstances, it may be more useful to open an account remotely (if, for example, you are just opening up a tiny account; it might not be economically viable to travel completely to the country of choice).

Variables that will establish the finest area to open an overseas checking account would certainly be: What is your initial down payment? What kind of account do you require? Where do you live and what passport do you hold? What kind of financial services do you call for? What is the purpose of the account? What are your tax responsibilities? The above information may assist you obtain a general suggestion of the kind of overseas account you are looking for, however, for a much more tailor-made overseas solution, it is best to get a customised strategy as each nation has refined distinctions that can make all the difference.

Some Known Details About Offshore Banking

One does not have to look very much across the globe headings to see that corrupt routines are still at large. Staying in a high-risk setting, it is only sound judgment that one would certainly intend to have a savings kept in a various location for safekeeping. Also in even more 'autonomous' countries that could not be directly intimidating there are still economic as well as economic uncertainties that would want to be well gotten ready for.

anchor linked here Your Domain Name